Hemp-Derived THC Products: Legal or Loophole?

Hemp-derived CBD products have exploded onto the market since Congress removed hemp from the Controlled Substances Act (CSA) in the 2018 Farm Bill. Now, new hemp-derived products are emerging that contain amounts of THC comparable to state-regulated marijuana consumer products, which are still illegal under federal law and highly regulated by states with adult-use and medical cannabis programs. These new “hemp-derived THC” products present a novel question: Do they impermissibly exploit a legal loophole or are they the first THC products that legitimately fall outside the CSA? Answering this question requires an understanding of the legalization of hemp-derived consumer products.

Hemp-Derived THC and the CSA

Congress legalized hemp in the 2018 Farm Bill by amending the CSA in two ways. First, Congress removed hemp from the CSA’s definition of marijuana by excluding any part of the marijuana plant with less than 0.3% THC by dry weight concentration. Second, hemp derivatives with less than 0.3% THC concentration also were removed from the CSA. Any THC that is derived from compliant hemp could therefore – in theory – legally cross state lines and be sold without fear of prosecution under the CSA.

Hemp-derived CBD products have exploded onto the market since Congress removed hemp from the Controlled Substances Act (CSA) in the 2018 Farm Bill. Now, new hemp-derived products are emerging that contain amounts of THC comparable to state-regulated marijuana consumer products, which are still illegal under federal law and highly regulated by states with adult-use and medical cannabis programs. These new “hemp-derived THC” products present a novel question: Do they impermissibly exploit a legal loophole or are they the first THC products that legitimately fall outside the CSA? Answering this question requires an understanding of the legalization of hemp-derived consumer products.

Hemp-Derived THC and the CSA

Congress legalized hemp in the 2018 Farm Bill by amending the CSA in two ways. First, Congress removed hemp from the CSA’s definition of marijuana by excluding any part of the marijuana plant with less than 0.3% THC by dry weight concentration. Second, hemp derivatives with less than 0.3% THC concentration also were removed from the CSA. Any THC that is derived from compliant hemp could therefore – in theory – legally cross state lines and be sold without fear of prosecution under the CSA. Indeed, a perhaps unintended consequence of the Farm Bill in this context is its strict prohibition on state interference with the interstate transportation or shipment of hemp or hemp products that are produced under an approved state plan.

Hemp-Derived THC and the FDA

The 2018 Farm Bill also explicitly preserved the authority of the Food and Drug Administration (FDA) to regulate products containing cannabis or cannabis-derived compounds under the Federal Food, Drug and Cosmetic Act. The FDA currently prohibits THC or CBD products from being sold as dietary supplements or as food additives, though the agency is actively investigating whether a pathway should exist for certain CBD ingestible products through the agency’s rulemaking process.

Hemp-Derived THC and State Law

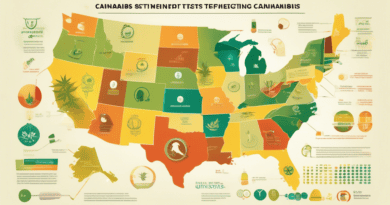

At the state level, the 2018 Farm Bill permits states to implement their own regulatory scheme for the production of hemp so long as the plan is approved by the U.S. Department of Agriculture (USDA). States that wish to maintain primary regulatory authority over the production of hemp within their borders must submit a plan to the USDA that includes, among other things, “a procedure for testing, using post-decarboxylation or other similarly reliable methods, delta-9 tetrahydrocannabinol (THC) concentration levels of hemp produced in the State.” The Farm Bill is silent, however, on states’ ability to regulate hemp-derived products. Several states have nevertheless adopted stringent labeling, packaging and testing rules for hemp-derived products.

Colorado, for example, has specific labeling requirements such as clearly identifying hemp as an ingredient, identifying CBD in the product, including the statement “FDA has not evaluated this product for safety or efficacy,” and ensuring the label does not contain any health or benefit claims. Colorado also requires all finished hemp-derived products to have a concentration of 0.3% THC or below to enter the consumer market.

Several other states, such as Oregon, Texas and Ohio, have similar requirements. Many states remain silent on hemp-derived consumer product requirements under state law. Other states expressly prohibit hemp-derived CBD products regardless of the relative concentrations of CBD or THC in the product. Any company that wishes to sell hemp-derived consumer products must therefore adopt a state-by-state risk management approach.

Example of a Hemp-Derived THC Product

Cannabinoid-infused products come in many forms. If a company wanted to produce a product with a meaningful concentration of hemp-derived THC comparable to traditional marijuana products, it must at a minimum ensure that the product contains less than 0.3% concentration of THC. So, for example, if a product serving contains 10mg of THC, which is comparable to a traditional regulated marijuana product, the product would need to weigh 3.33 grams to fall below the 0.3% THC requirement. The weight of an average gummy gelatin product is 2.6 grams.

Discussion

So where do hemp-derived THC products fall within this complicated legal landscape? The short and admittedly simplistic answer is that these products in ingestible form (1) are prohibited under current FDA guidelines, (2) may or may not be legal under state law depending on the state, and (3) appear to comply with a strict reading of what is legal under the 2018 Farm Bill. In short, they appear to fall outside the CSA.

It is important to keep in mind that the Farm Bill and related state hemp plans only regulate the cultivation of hemp, not the use of hemp in consumer products. If a manufacturer is able to ensure the hemp used to produce its product is compliant with less than 0.3% THC on a dry weight basis, the USDA should not intervene. The FDA’s restrictive position on THC in any ingestible form is clear, though the agency has traditionally deferred enforcement of THC-related issues to the Department of Justice and state law enforcement. That may change if hemp-derived THC products proliferate.

Again, state law requires a state-by-state analysis to determine whether a product is legal. There is no “one size fits all” solution and, depending on where a product is sold, there may be labeling, testing and other restrictions to satisfy before a hemp-derived product may be sold legally. To date, states that have enacted state regulations have focused on hemp-derived CBD – not THC or the so-called “novel” cannabinoids such as CBG, CBN and THCA.

Another important question is whether these products are misleading and subject to false advertising or deceptive consumer practices lawsuits. General public confusion regarding marijuana, hemp, CBD and THC is well documented. Intoxicating products that are marketed as federally legal could give rise to substantial civil liability under consumer protection statutes.

Hemp-derived THC products technically may not violate federal criminal law because they fall within an unintended legal loophole, but they certainly violate the spirit of federal law and should be handled with extreme caution until THC is formally removed from the CSA. After all, federal authorities have taken a hands-off approach to THC products only within the context of well-regulated state systems. Lingering uncertainty as to the legal status of these products will need to be addressed through legislation or by the courts. In the meantime, caution is warranted.

Authors: Ian A. Stewart, Devon S. Mills, Neil M. Willner