Cannabis Set to Outpace Alcohol in Consumer Growth

A recent report by the multinational investment bank TD Cowen highlights the growing influence of the cannabis industry on traditional alcohol sales, predicting a significant shift in consumer preferences over the next five years. According to the analysis, the cannabis market is quickly becoming a formidable opponent to the alcohol sector, with projections indicating that nearly 20 million additional individuals will become regular cannabis consumers by 2027, while alcohol is expected to see a decrease of about 2 million regular users.

In 2023, cannabis sales soared to $29 billion, capturing approximately 11% of the market share that alcohol traditionally holds. This marks a significant increase from just five years prior when cannabis accounted for only 4% of the market. The report forecasts an annual growth rate of 7% for the cannabis industry over the next five years, further solidifying its presence and impact.

The analysis, aptly named “Cannabis Beats Booze,” suggests a growing consumer preference for cannabis over alcohol, noting an anticipated addition of 18 million past-month cannabis consumers and a decline of 2 million past-month alcohol consumers within five years. This shift is attributed to an increasing acceptance of cannabis and a conscious decision by many to reduce alcohol intake. Vivien Azer, who led the team behind this analysis, shared with Marijuana Moment that the data supports a longstanding prediction that cannabis would disrupt alcohol sales. The extent of alcohol’s underperformance, especially in states where marijuana is legal, was notably surprising to researchers.

Analysts believe that the alcohol industry is at a crossroads due to a noticeable preference for cannabis over alcohol among consumers, particularly younger demographics. A proprietary survey conducted by TD Cowen found that over two-thirds of cannabis users reported a decrease in alcohol consumption. This trend is especially pronounced in states with legal cannabis access, where alcohol sales are lagging behind those in states where marijuana remains illegal.

The evolving landscape of state marijuana markets and recent legalizations in states like Minnesota and Ohio are expected to contribute to an estimated $37 billion in cannabis sales by 2027. While alcohol companies may not immediately feel the impact of these shifting consumer trends, which predominantly involve younger individuals cutting back on alcohol, the long-term outlook suggests potential challenges for certain brands, with beer sales identified as particularly vulnerable.

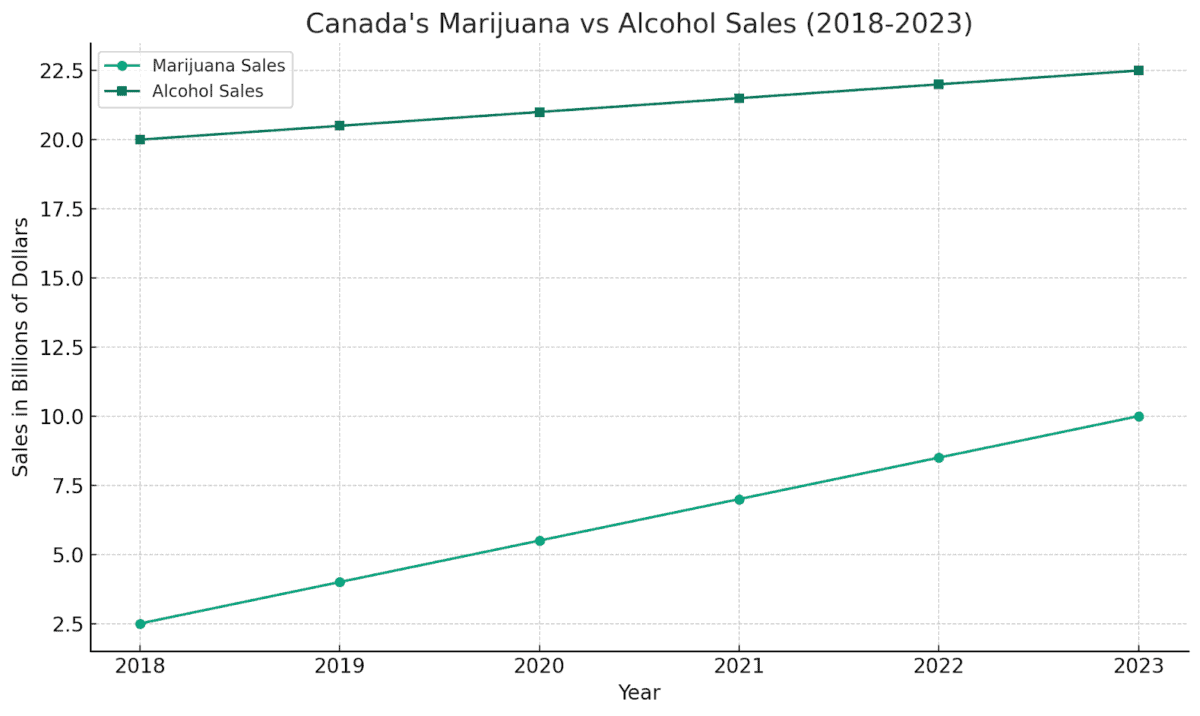

The alcohol industry’s potential foray into the cannabis market remains speculative, pending significant legislative or administrative changes at the federal level. TD Cowen’s report also examines Canada’s experience with national marijuana legalization as a case study, finding that Canadian cannabis sales now constitute 20% of the alcohol market’s size.

Supporting the TD Cowen analysis, additional research, including a study on California’s young adults, suggests a “substitution effect” where legalization is linked to reduced alcohol and cigarette consumption. National surveys further reflect a growing perception among Americans that marijuana is less harmful than alcohol, cigarettes, vapes, and other tobacco products, with cannabis also seen as less addictive.

State-level data reinforces the report’s findings, with examples from Michigan, Illinois, and Colorado showcasing the cannabis industry’s capacity to outperform or closely match alcohol and tobacco sales, underscoring the significant economic impact and changing consumer behaviors favoring marijuana over traditional substances.