Oregon Cannabis Companies are Fast Approaching Final Deadline to Enroll Employees in OregonSaves

Cannabis employers in the state of Oregon will be required to offer their employees a retirement savings program to save in, regardless of how many employees they have—whether it be one or 100.

OregonSaves was designed to be relatively hands-off for the employer (though business owners do have certain ongoing responsibilities related to the program), but as such, administrative and plan fees are charged to the employee rather than the employer. Employee fees cost approximately 1 percent of assets per year—in other words, employees will pay about $1 in fees for every $100 in their account. The fees cover plan administration, fees of the trustee/custodian, and operating expenses charged by funds in which the program’s investment options are invested.

Employees will also need to adhere to strict Roth IRA contribution limits: $6,000 annually for those age 50 and under and an additional $1,000 per year in catch-up contributions for those over the age of 50. Employees also have the option to change their IRA account from Roth to Traditional, which may be necessary for certain employees—especially high-earners who exceed Roth IRA income limitations set by the federal government.

Aren’t Cannabis Companies Exempt From Oregon’s Mandatory Retirement Law?

Nope. A quick “Control F” search for the word “cannabis” or “marijuana” in the text of the law will show clearly that such companies are not exempt from having to facilitate the OregonSaves IRA program (else, they must offer a retirement plan):

OregonSaves is set up as a Roth IRA, meaning employees will pay tax on contributions upfront but distributions will be tax-free at retirement time. Employees are auto-enrolled in the program at 5 percent of their gross pay, with an annual automatic contribution increase of 1 percent until the employee is contributing 10 percent of their salary to the account. The account is held in the employee’s name, so regardless of whether they change jobs, move, or instead stay with the same employer until they retire, the account will always remain with them.

Employer responsibilities for facilitating OregonSaves include:

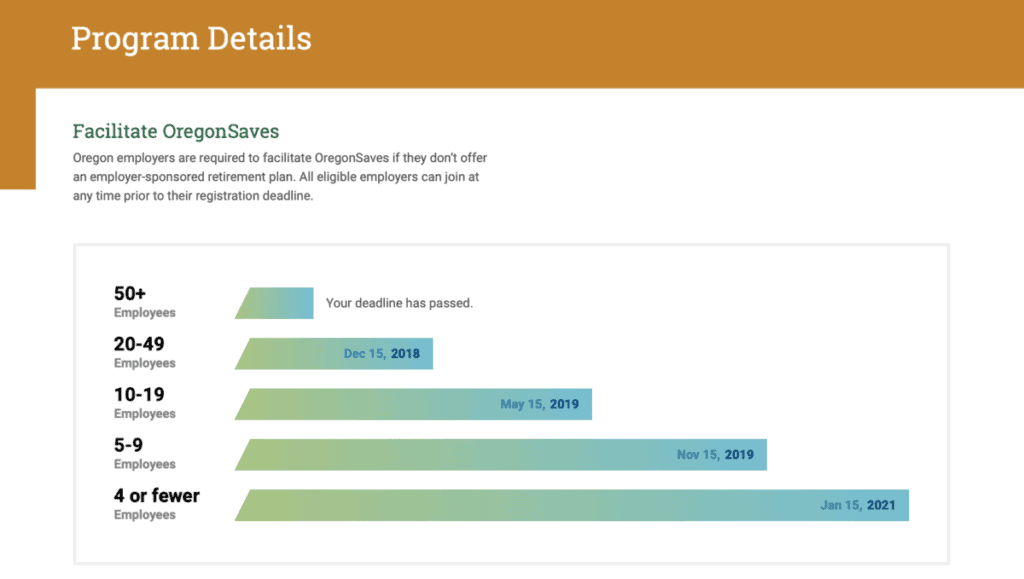

- Registering for the program prior to registration deadlines

- Adding delegates/payroll representatives to assist with ongoing account maintenance

- Setting up payroll

- When registering and setting up OregonSaves, employers must add at least one payroll list and set a payroll date that’s at least 30 days from the date the list was created so employees can opt out of the program or customize their account settings if they choose.

- Adding employees to the program

- Employers will be responsible for adding all eligible employees, regardless of whether they’ve expressed interest in being involved or not, so OregonSaves can contact them to help the employee set up their account elections or opt out of the program entirely. Employers can choose to either do this manually or by using the Employee Information Template spreadsheet available on the OregonSaves website.

- Sending timely contributions

- This one is important: employers will have to ensure they are deducting the correct percentage from each employee’s regular paycheck as determined by the employee. This can again be done manually using an online form or by using OregonSaves’ Employee Contribution Template spreadsheet.

- Performing ongoing maintenance

- Lastly, employers will have various ongoing maintenance tasks, such as submitting employee contributions each payroll period and ensuring their employee list is accurate and up-to-date with new hires, newly eligible employees, etc.

Is a 401(k) Plan a Good Alternative to OregonSaves?

Is a 401(k) plan a good alternative to the OregonSaves IRA for a cannabis company? It is. While there are other retirement plans (e.g., 401(a) and 403(b) plans, Simplified Employer Plans, SIMPLE IRAs, etc.), the very common 401(k) plan is a good retirement plan choice for cannabis companies trying to comply with Oregon’s mandate and to offer one that most employees readily recognize. A 401(k) plan allows a cannabis company input in designing the terms of the plan (eligibility, age of participating, length of minimum service, vesting, employer contributions, etc.). For example, a cannabis company might want to match employee contributions.

Does the new Oregon law regarding mandatory retirement programs apply to cannabis companies?

YES, it does.

As another example, maybe the cannabis company might want to allow profit sharing. Or, the cannabis company might want to help select the investments into which its employees will put their money. Consequently, a 401(k) plan might be more suitable for a cannabis company who wants to have control in the design of its ultimate retirement plan.

Can Cannabis Companies Participate in a 401(k) Plan?

While cannabis remains illegal under the federal law of the Controlled Substances Act, under the federal laws of the Internal Revenue Code (through which the Department of Treasury enforces its federal laws) and the Employee Retirement Income Security Act (“ERISA,” through which the Department of Labor enforces its federal laws), cannabis companies can sponsor and/or participate in 401(k) plans. For an exploration through those federal laws and how cannabis companies can have 401(k) plans, see “Once and For All: Internal Revenue Code and ERISA Say Cannabis 401k Plans Can Exist” and “Issues for Cannabis Companies to Consider When Sponsoring Retirement Plans.”

What Are the Benefits of a Cannabis Company Starting Its Own 401(k) Plan?

Cannabis companies are allowed to have 401(k) plans.

There are federal tax credits available to a cannabis company that starts its own 401(k) plan

Last year, President Trump signed the Further Consolidated Appropriations Act, 2020 into law on December 20, 2019. That law provides comprehensive retirement plan legislation in over a decade: the Setting Every Community Up for Retirement Enhancement (SECURE) Act. Most relevant to any company starting a 401(k) or other retirement plan is the federal tax credit that the SECURE ACT offers to businesses with 100 employees or fewer.

Remember: A federal tax credit reduces tax liability dollar for dollar, whereas a federal tax deduction reduces the amount of taxable income. Taxable income, in turn, is used to calculate tax liability. Tax credits are generally more valuable because they reduce federal tax liability (i.e., the amount owed to the federal government). Tax deductions, on the other hand, reduce tax liability by the tax rate for every dollar of the deduction.

A cannabis company can take advantage of what could be a federal tax credit of $5500/year (for three years) for its 401(k) retirement plan.

Under the SECURE ACT, any company — including a cannabis company — can get up to $5,000 annually in a federal tax credit in starting or participating in a new 401(k) plan. Moreover, if the 401(k) plan has an automatic enrollment feature (where employees are put right into the 401(k) plan, unless and until they opt out), then there is another $500 annual federal tax credit.

Thus, a cannabis company could be entitled to $16,500 in federal tax credits over a three-year period for offering a retirement plan to its employees.

There are HR benefits for a cannabis company to have a 401(k) plan

In all industries, whether cannabis or non-cannabis, 401(k) plans are known to help with recruiting, hiring, and retention of employees. It is a nice perk to have, and one that can be put into place to keep a cannabis company competitive with overall compensation packages.

Moreover, subject to Section 280E, a cannabis company’s contribution of employee money and match to a 401(k) plan are “deductible.” That is, contributions are permissible “costs of goods” sold adjustments. Treas. Reg. Section 1.263A-1(e)(3)(ii). [The Editor recommends a good tax accountant familiar with inventory accounting.] Further, amounts get to grow income-tax free inside of a trust, and the trust pays no income taxes itself.

As for the 401(k) trust (where assets are held separate from the cannabis company’s business assets), company creditors — even with the cannabis company in bankruptcy — cannot make a successful claim on retirement plan assets. See U.S. Department of Labor, “FAQs about Retirement Plans and ERISA,” p. 13, June 1, 2020.

Finally, if the cannabis company ever terminates its 401(k) plan or if an employee terminates employment, rules under the Internal Revenue Code and ERISA permit the employee to rollover the account balance into another retirement plan or IRA.