Regulatory Hurdles in Cannabis Interstate Commerce

Introduction

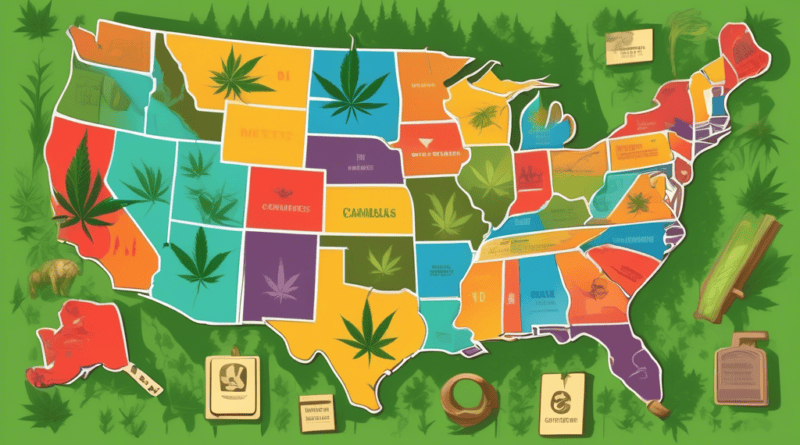

As the legal landscape surrounding the cannabis industry continues to evolve, the lack of federal approval in the United States remains a significant barrier. Consequently, the introduction of cannabis interstate commerce—one of the industry’s most anticipated milestones—faces a host of regulatory hurdles. These challenges encompass a range of issues, from legal inconsistencies and logistical complications to tax implications and enforcement disparities.

Legal Inconsistencies Between States

One of the primary challenges to cannabis interstate commerce stems from the differing legal statuses of cannabis across state lines. While some states have fully legalized cannabis for both medical and recreational purposes, others maintain strict prohibitions. This disparity creates a complex regulatory environment where a product legal in one state might be illegal just a few miles away in another. This patchwork of state laws poses a significant hurdle for any sort of seamless interstate commerce.

Lack of Federal Legalization

The absence of federal legalization is another pivotal issue. As cannabis remains classified as a Schedule I substance under the Controlled Substances Act of 1970, interstate commerce involving cannabis is effectively illegal on a federal level. This federal prohibition prevents cannabis businesses from transporting products across state lines and contributes to an uncertain legal environment that stifles interstate commerce ambitions.

State-Specific Regulatory Frameworks

Additionally, each state that has legalized cannabis operates under its own regulatory framework. These frameworks often include distinct licensing requirements, quality control measures, and taxation policies. Navigating these disparate rules can be incredibly challenging for businesses seeking to expand their market reach through interstate commerce. They must understand and comply with the regulatory parameters in each jurisdiction where they intend to operate.

Logistical Complications

The logistics of cannabis interstate commerce present another set of challenges. Transporting cannabis requires strict adherence to a range of state and possibly federal regulations, including secure transport measures and meticulous inventory tracking. Additionally, the perishable nature of cannabis products can complicate long-distance transportation, necessitating advanced and costly shipping and storage solutions.

Security Concerns

Security is a top priority when transporting cannabis due to its high value and the associated risk of theft or diversion. States with legal cannabis industries typically have stringent security measures in place, such as the use of armed guards or GPS tracking during transportation. These requirements can add significant costs and logistical complexity to moving cannabis products across state lines.

Tax Implications

Interstate commerce in cannabis is also heavily impacted by tax considerations. States that have legalized cannabis typically impose various taxes on the sale, distribution, and cultivation of cannabis products. The introduction of interstate commerce could complicate tax collection and enforcement, leading to potential revenue losses and disparities between states.

Double Taxation Risks

One significant risk is the potential for double taxation. Both the state where the cannabis is produced and the state where it is sold may seek to impose taxes. This could significantly drive up costs for consumers and create an accounting nightmare for businesses, further discouraging interstate commerce.

Enforcement Disparities

Enforcement disparities add yet another layer of complexity to cannabis interstate commerce. Different states have varying levels of enforcement rigor concerning cannabis laws. This can result in legal ambiguities and uneven playing fields where businesses in states with looser enforcement may have a competitive advantage over those in states with stricter controls.

Federal vs. State Enforcement

The tension between federal and state enforcement is an underlying issue. While some states have opted not to vigorously enforce federal cannabis prohibitions, the federal government retains the authority to intervene at any time. This unpredictable enforcement landscape can deter businesses from participating in interstate commerce due to the fear of potential federal crackdowns.

Conclusion

The regulatory hurdles facing cannabis interstate commerce are multifaceted and formidable. Legal inconsistencies between states, logistical complications, tax implications, and enforcement disparities collectively pose significant challenges. Overcoming these hurdles will likely require a concerted effort involving legislative changes, harmonization of state regulations, and possibly federal legalization. Until such changes take place, cannabis interstate commerce will remain an ambitious yet elusive goal for the burgeoning industry.